The Essentials of Long Term Care (LTC)

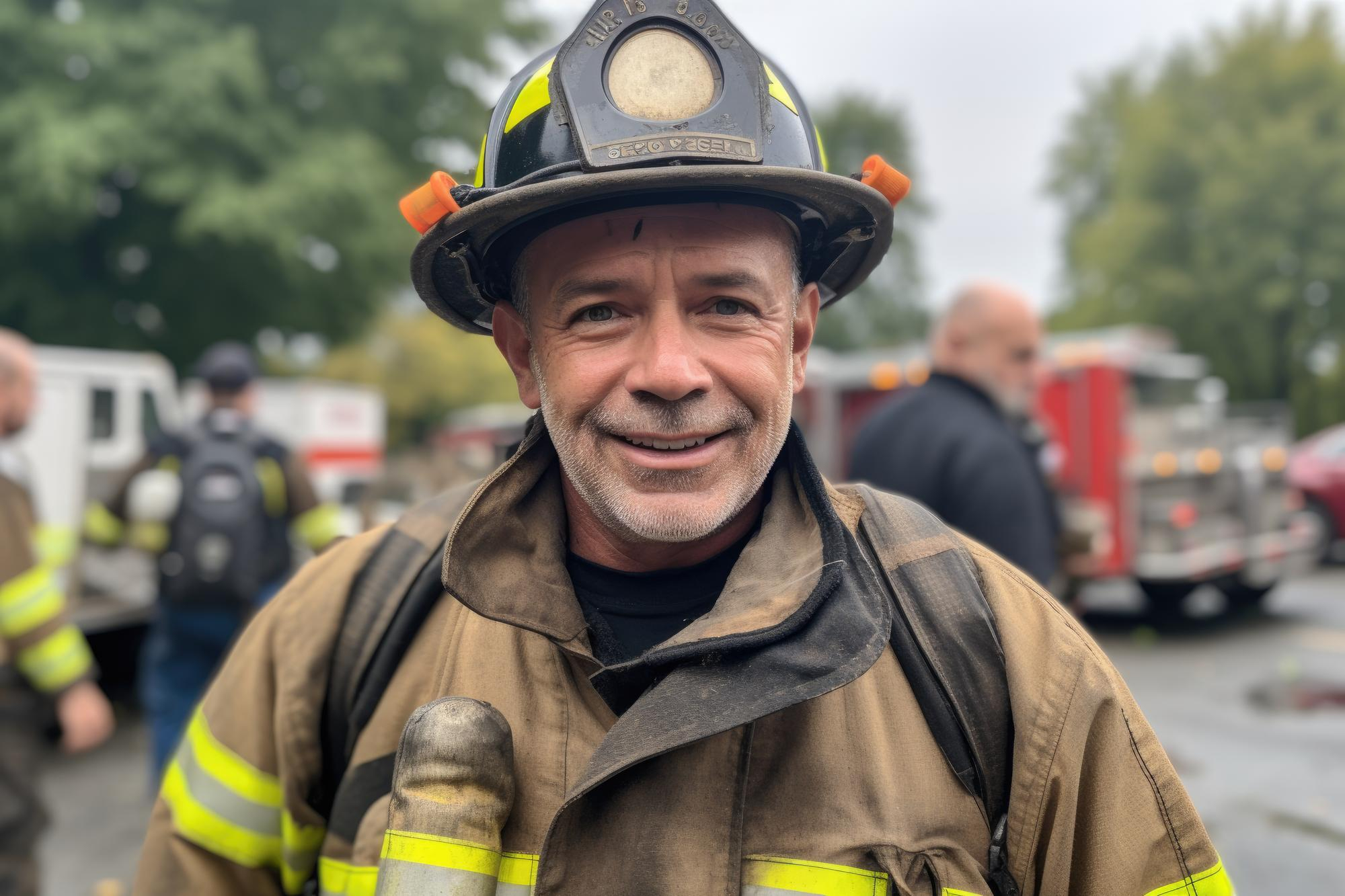

What Every Firefighter Needs to Know About LTC

Why LTC Should Be on Your Radar Now

Being a firefighter isn’t just a job; it’s a calling. The risks, the physical demands, the stress—it’s all part of the package. But while you’re busy saving lives and protecting property, who’s looking out for your future? That’s where Long-Term Care (LTC) comes in. Let’s break it down so you can see why LTC isn’t just a nice-to-have—it’s a must-have.

LTC is all about making sure you get the help you need when you can’t handle daily activities on your own. Whether it’s due to an injury, illness, or simply aging, LTC covers services at home, in assisted living, or in nursing homes. Think of it as a safety net that ensures you live with dignity and financial security.

1. You’re at a Higher Risk—Period

Firefighting is one of the most dangerous professions out there. You’re constantly exposed to extreme conditions and physical hazards. According to the National Fire Protection Association (NFPA), there were 58,250 firefighter injuries in 2018 alone, with strains, sprains, and muscular pain accounting for the majority. This makes LTC insurance a no-brainer for anyone in the field.

2. Mental Health is a Serious Concern

The mental toll of firefighting is significant. Exposure to traumatic events, high-stress situations, and long hours can lead to serious mental health issues. A study by the Ruderman Family Foundation found that more firefighters die by suicide than in the line of duty, with an estimated 103 firefighter suicides in 2017. LTC insurance can include mental health support, ensuring you get the help you need.

3. Early Retirement and Lower Life Expectancy

Firefighters often face early retirement due to the physical demands of the job. Many retire in their 50s, much earlier than the average retirement age of 62 in the U.S. Additionally, firefighters have a lower life expectancy compared to the general population, largely due to the cumulative physical and mental stressors of the job. Planning for LTC now ensures you’re covered for those extended retirement years.

1. Protect Your Wallet

The costs of long-term care can be astronomical. The Genworth 2020 Cost of Care Survey reports that the median annual cost for a private room in a nursing home is $105,850. That’s pre-Covid and hyperinflation that we have now in 20224! Without LTC insurance, these expenses can wipe out your savings. Insurance helps preserve your assets and keeps you financially secure.

2. Quality Care Access

With LTC insurance, you don’t have to settle for mediocre care. LTC insurance guarantees access to high-quality care that fits your needs, whether it’s at home, in an assisted living facility, or a nursing home. This can significantly improve your quality of life during retirement.

3. Ease The Family Burden

LTC insurance reduces the emotional and financial strain on your family, who might otherwise need to provide or pay for your care. It provides peace of mind, knowing that your long-term care needs will be met without burdening your loved ones.

4. Guaranteed Coverage

Secure LTC insurance while you’re in good health. Doing so ensures you’re covered no matter what health changes come your way. This proactive approach prevents the risk of becoming uninsurable later.

2. High Costs of Care – The average monthly cost of a private room in a nursing home is around $8,821, totaling over $100,000 annually (Genworth).

3. Mental Health Impact –Firefighters face high rates of PTSD and depression, with studies indicating that up to 20% of firefighters experience PTSD (Ruderman Foundation).

4. Early Retirement Trends – Many firefighters retire in their 50s, significantly earlier than the U.S. average retirement age of 62 (NFPA).

5. Lower Life Expectancy – Firefighters have a life expectancy of around 62 years, compared to the general population’s average of 79 years (NFPA).

Long-term care (LTC) is all about having the support you need when you can’t do everyday tasks on your own anymore. It’s a range of services designed to help you live as independently and safely as possible, whether that’s at home, in an assisted living facility, or in a nursing home.

Key Components of LTC

1. Personal Care – Help with daily activities like bathing, dressing, and eating.

2. Health Care – Medical services from skilled professionals, like nurses and therapists.

3. Support Services – Assistance with household chores, transportation, and meal preparation.

1. Assess Your Future Needs & Add Them To Your Financial Plan

Evaluate your health, family history, and finances. What level of coverage makes sense for you? What will you likely need or run into in the future? Consider chronic illnesses, family longevity, and your asset portfolio. Planning for LTC costs is crucial to ensure you can afford the care you need when the time comes.

Remember, LTC insurance is a key part of financial planning. It helps cover the cost of care services, easing the financial burden on you and your family. Key benefits include:

- Peace of Mind – Know your future care needs are covered, cutting down on anxiety about potential costs.

- Financial Stability – Protect your savings and assets from being drained by care costs.

- Preferred Rates – Score potentially lower premiums through specialized providers and non-profits such as NPFBA.

2. Shop Smart

Reputable providers, special associations and non-profits such as NPFBA offer tailor-made LTC programs for firefighters. Compare coverage options, premiums, benefit triggers, and the provider’s financial stability.

3. Know Your Policy Options

LTC policies vary. Key features to consider:

- Elimination Period – The waiting period before benefits kick in.

- Benefit Amount – The daily or monthly benefit amount.

- Benefit Period – How long benefits are paid.

- Inflation Protection – Adjustments to keep benefits in line with inflation.

4. Apply While You’re Healthy

Get your application in while you’re still in good health to lock in the best rates and guarantee coverage. Some policies might require a medical exam.

5. Review Regularly

Your LTC needs might change. Review your policy periodically to ensure it still meets your needs. Make updates as necessary.

Secure Your Future Now

Long-term care isn’t just a luxury for firefighters; it’s a necessity. With LTC insurance, you get financial security, access to quality care, and peace of mind for you and your family. Understand the essentials and take proactive steps to secure coverage now.

Incorporate LTC planning into your financial strategy. Protect your future and keep doing what you do best—saving lives and protecting your community with confidence.

Hear From The Frontline

Testimonials

“I want to thank NPFBA for their help and guidance in getting in-home care for my wife. Their warm professional demeanor and empathy for our difficult situation went beyond my expectations. The staff is always available to answer questions and their suggestions made the process go smoothly. We are extremely grateful for everything NPFBA has done.”

– Doug Schulte on on behalf of Dorlue Schulte

San Diego City Fire Department

“NPFBA’s assistance has allowed me to focus on my recovery and not how to facilitate that recovery financially. I cannot express how important the Long Term Care (LTC) Plan has been to my rehabilitation. I consider myself extremely lucky to be a part of such an exceptional organization.”

– Sean Simonson

City of Milpitas Fire Department

“A year after retiring, I was diagnosed with Amyotrophic Lateral Sclerosis (ALS), more commonly referred to as Lou Gehrig’s disease. After three years, in-home caregivers were needed to assist with my daily living needs and NPFBA was contacted. NPFBA’s staff members were extremely helpful and compassionate. My LTC benefit requests have always been processed promptly and accurately. Being protected with NPFBA-LTC gives me peace of mind knowing I’m well covered along my journey.”

– Keith Kumada

City of Sunnyvale Department of Public Safety

An Institution That Knows You

- NPFBA was established in 1999

- Over 12,200 LTC Plan Participants

- NPFBA offers the only long term care plan created specifically for safety and non-safety members of law enforcement & fire service personnel & their spouses.

- Over $170 million in assets

- Average monthly cost to Participant – $69

- Members can now purchase a second LTC policy for themselves and/or their spouse to ENHANCE your LTC benefit coverage.

At NPFBA, we’ve built our LTC policies around the real-life challenges and aspirations of firefighters in California. It’s not just about covering potential health adversities but understanding the deep-seated motivations, preferences, and pain points. Our promise is to walk with you, ensuring your future is as secure as the Californians you protect daily.

Guidance at Every Step

Not sure how to integrate your LTC policy into your financial plan? Our team of experts, familiar with the financial intricacies of California’s firefighters, is here to guide you.

Simplifying the Complex

Financial products can seem complicated, but we strive to make understanding your LTC policy easy:

- Clear communication about all aspects of your policy.

- Transparent breakdown of benefits, fees, and potential drawbacks.

- Dedicated support for all your queries.

Secure Your Future Today!

🌟 Your Health, Our Mission:

We understand the unique challenges faced by firefighters. That’s why our LTC plans are more than just insurance; they’re a promise. A promise to stand by you, as you’ve stood by California.

More Resources

7 Common Firefighter Injuries (and a Hot Tip)

It’s no secret that firefighting carries inherent risks to life and limb, whether a firefighter is putting down a fire at an empty warehouse or a two-story residential structure. Simply put, it isn't uncommon for firefighters to get injured – sometimes severely, to...

4 Ways Firefighters (and Spouses) Can Earn Passive Income

Whether you are a firefighter with a full-time schedule or the spouse of a firefighter who manages the household full time, there are still ways to earn passive income. As everyone knows, every bit of income will add up to a more comfortable retirement (where peace of...

4 Quick & Dirty Options For Police And Firefighter Couples On Valentines Day

Warning: This blog is intended for mature audiences only. Hey, I said mature audiences only! Joking! But seriously, now that the kids are out of the room, let’s talk: What is your plan for long-term care? Kidding again! Ok, this time it’s for real: What’s your plan...

4 Great Second Jobs For Firefighters

Many people are under the false impression that firefighters cannot have second jobs, and most of the time, this isn’t true. Depending on the employer, whether private or public, municipality or state, second jobs are completely acceptable as long as they don’t...

6 Keys To Life As A Fire Spouse

If you’re thinking about becoming a fire spouse, chances are you’ve run into people, strangers and acquaintances, who have offered some words of wisdom. You might even have close friends in your position. Whatever the case may be, well meaning advice is probably all...

4 Basic Tips for Organizing Your Family Around a Firefighter Schedule

One common firefighter schedule, the 24/48, is named for the rotating hours on and hours off. It requires a 24-hour shift followed by 48 hours off. Another common firefighter schedule is the 48/96, which means two days (48 hours) on and four days off. Both schedules...

Top 5 Largest Wildfires In California History

Not only did 2020 bring unprecedented suffering in terms of a global pandemic, three of the five largest fires in California history burned a total of 1.8 million acres that year. With a multi-year drought encompassing most of the Western half of the U.S., California...

Important Letter Regarding Your Long Term Care

We wanted to update you on the current status of your National Peace Officers and FireFighters Benefit Association (NPFBA) long-term care (LTC) plan (Plan). There have been recent concerns over other LTC plans operating in California. NPFBA does not anticipate...

Why You Should Have Long Term Care

As the cost of care continues to rise, Long Term Care (LTC) coverage becomes an increasingly important component of every American’s safety net. Traditional health insurance does not cover most LTC services. State and Federal programs only cover people with low...

10 Reasons to Choose Long Term Care

Nursing Home Care Covers inpatient room and board, supplemental services, and patient supplies. You are eligible when you can't perform 3 or more Activities of Daily Living (ADLs). Refer to Glossary page for Activities of Daily Living. Residential Care Covers...