As a person’s career advances, or even begins to wind down, depending on how you look at it, there comes a time to consider a whole host of topics, such as long-term care options and retirement plans. But a third category is just as important as those other two: estate planning. Understanding some fundamental terms associated with your estate, and more specifically, what happens to your assets after you are gone, is critical.

A trust, in simple terms, serves as a legal third-party that actually becomes the “owner” of the contents of the trust creator’s estate. (In this article, a “trust” refers to a “revocable trust,” which is one that can be changed at any time while the creator (you) is living.) In effect, you create a trust specifically so that the transfer of ownership happens while you are still alive (with a couple of details, which I’ll mention below). This transfer of ownership to the trust means that your estate won’t go into probate after you die. Probate is a lengthy and expensive process by which the court transfers ownership to those you have designated as your heirs. When a trust is in place, the transfer of ownership of belongings and assets, after a person dies, can get underway immediately.

What does it mean to fund a trust?

Basically it’s the second step of creating the trust. The first step is having the document created by an estate lawyer. The reason an estate lawyer is needed is because a trust is actually a legal contract and falls under the jurisdiction of contract law, and it is a more complex process to create one than a simple will.

Funding the trust is when you physically fill out paperwork and change the title (ownership) out of your individual (or joint) name and into the name of the trust. For example, if you own a house, you would fill out a new title document that removes “John Doe” as the owner and adds “John Doe Revocable Trust” as the owner of the house.

Ownership of any other titled possessions you decide to include as part of the trust must be transferred to the trust the same way: real estate holdings, cars, etc. So, funding a trust simply means transferring the ownership of your assets to the trust. Additionally, part of creating a trust is naming your beneficiaries, that is, who the ownership will be transferred to upon your death. The key thing to remember here is that the trust is the owner of an asset while you are still alive, not the person you name to become the owner someday. You remain in control of the contents of your trust while you are alive. If you become incapacitated, or otherwise unable to make changes, there is a process for naming someone else ahead of time to control the trust while you are still alive, in the event you are unable to do it yourself. For obvious reasons, this should be someone you trust highly.

What about non-titled assets, like jewelry or antiques?

Any and all possessions can be part of your living trust. In addition to real estate, cars and other titled items, your belongings can also be named as part of the trust, along with the name of those who will inherit the items.

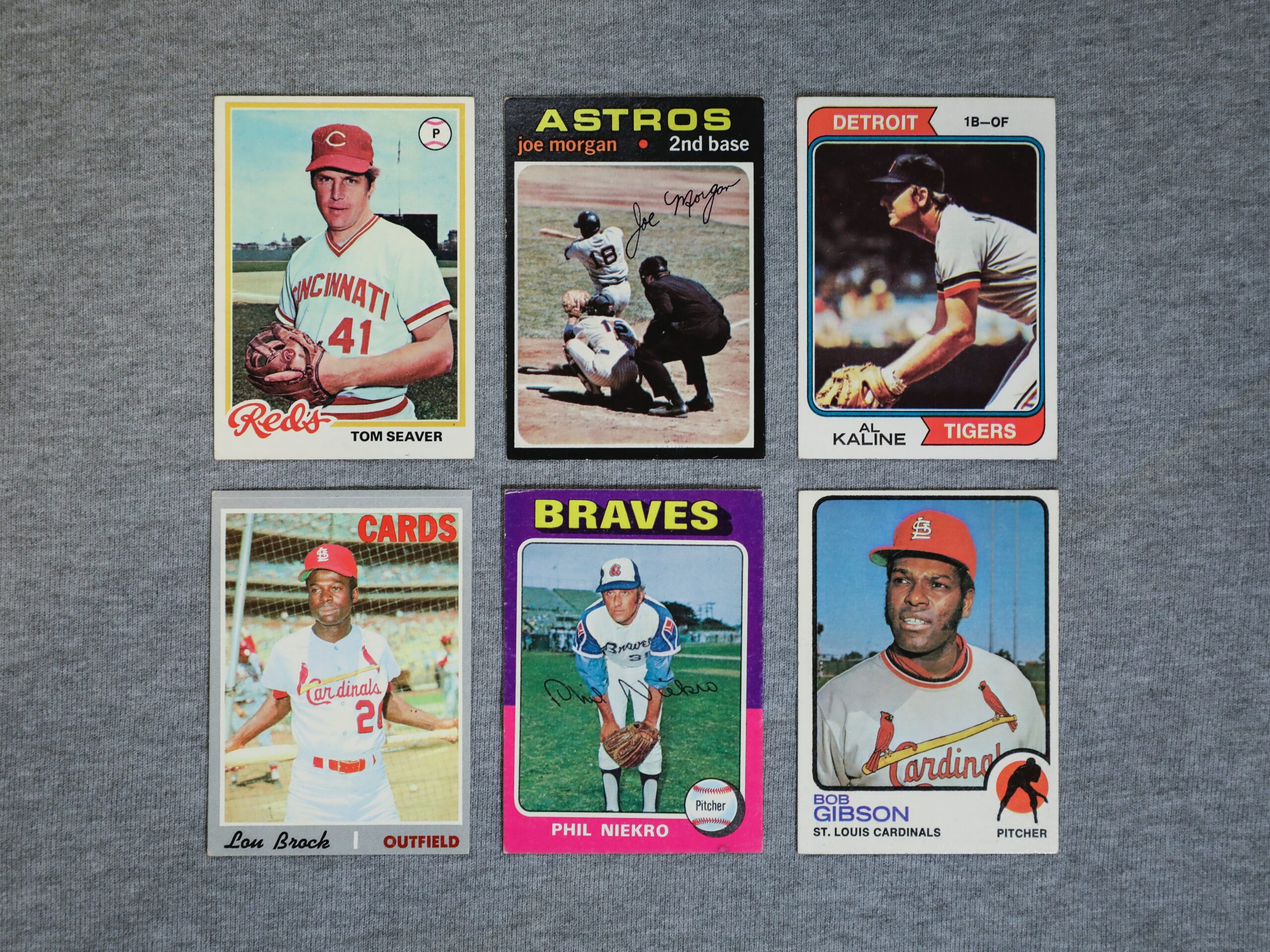

Revocable trusts are living documents. If you and your cousin have a falling out and you no longer want him to inherit your baseball trading cards collection after you die, you simply call your attorney and make the change (with some paperwork, of course). If you and your cousin make up, you can make another change and put your original wishes back in place.

Funding your trust, or changing the titles while you are still alive means that the courts don’t have to do it later. It eliminates a middleman, in effect, so that hopefully your heirs can receive the assets and belongings that you want them to have with as little headache as possible.

The decision as to whether you need a living trust or a last will and testament should be made only after consulting with a financial planner or estate lawyer. If you do decide to create a trust, don’t forget to fund it. Not following through with this critical step of filling out the necessary paperwork for each titled asset, which your estate planner can help you with, will result in an expensive and time-consuming issue for your heirs.