There is an entire ocean of personal finance apps out there. Luckily, we have taken the time to roung up 11 of the best to help you stay at the top of your money game.

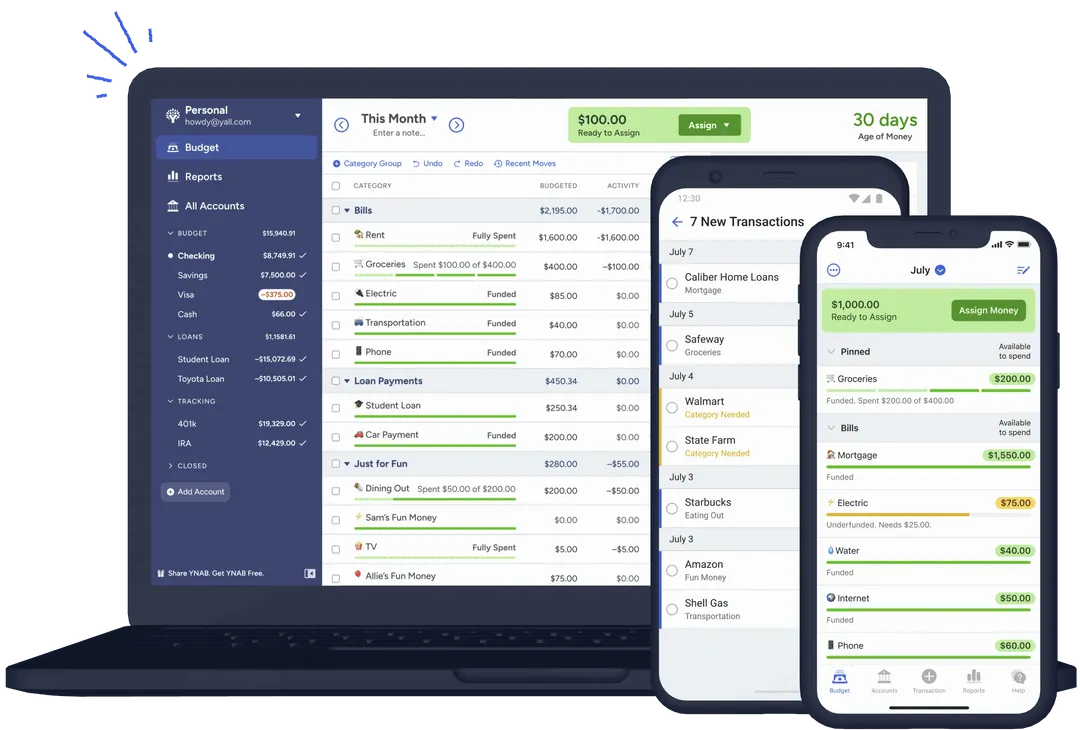

1. YNAB (You Need A Budget) – Your Personal Finance Boot Camp

YNAB is the drill sergeant your money needs. It’ll whip your finances into shape faster than you can do burpees.

- Forces you to give every dollar a job – no slacking allowed

- Teaches you to live on last month’s income – bye-bye, paycheck-to-paycheck life

- Adapts to income fluctuations – perfect for those overtime-heavy months

Power Move – Start with YNAB’s free trial, then write off the annual fee as a “professional development” expense. Your accountant will high-five you.

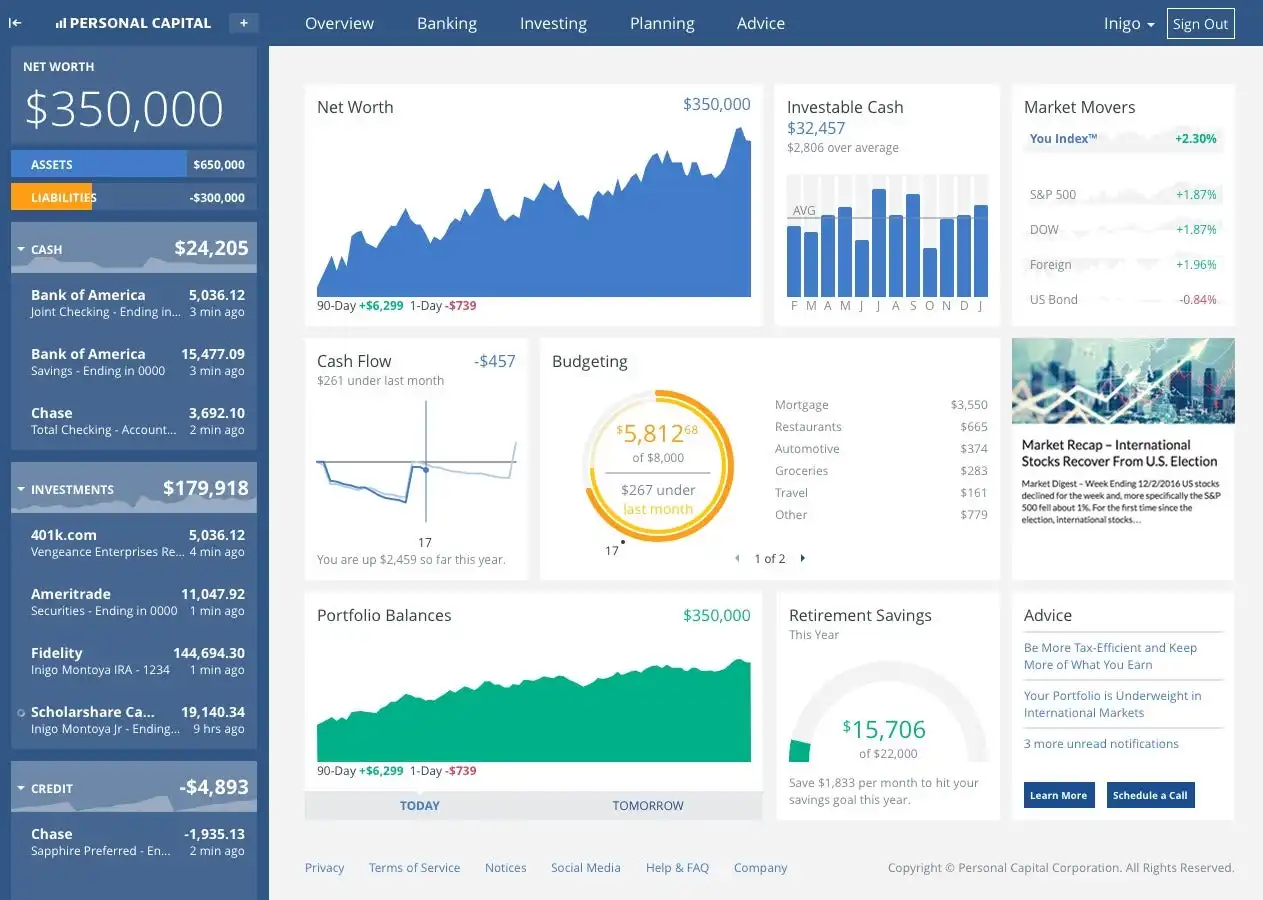

2. Personal Capital – Your Financial SWAT Team

Personal Capital (Now Empower) – For when you’re ready to go beyond budgeting and start building serious wealth.

- Tracks investments like a hawk – no sketchy stock will slip by

- Analyzes fees – because those sneaky charges are the real criminals

- Offers a free retirement planner – see if you’re on track or headed for a financial 187

Insider Hack – Use Personal Capital’s “Investment Checkup” tool quarterly. It’s like a fitness test for your portfolio.

3. Acorns – The Stealth Wealth Builder

Acorns is like finding spare change in a perp’s couch – but way more profitable.

- Rounds up purchases and invests the difference

- Offers pre-built portfolios – from conservative to aggressive

- Includes a checking account with no overdraft fees – because who needs that stress?

Tactical Advantage – Set up recurring investments. Even $20 a week can grow to over $100K in 30 years. That’s a lot of donuts.

4. Robinhood – For the Adrenaline Junkies

Want to play the stock market without the Wall Street BS? Robinhood‘s your go-to.

- Commission-free trades – more money for you, less for suit-wearing middlemen

- Fractional shares – own a piece of Amazon for less than the cost of Prime

- Crypto trading – because why not add some digital gold to your stash?

Warning – This isn’t for the faint of heart. Only invest what you can afford to lose, hotshot.

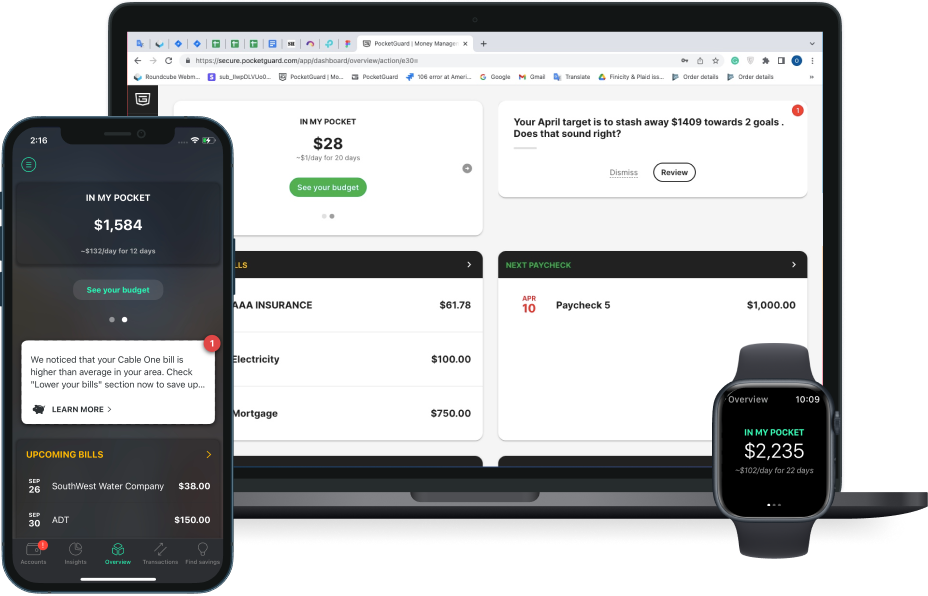

5. PocketGuard – Your Financial Body Armor

PocketGuard is like your bulletproof vest, but for your wallet.

- Finds bills you can lower – negotiates them for you

- Shows how much you have left to spend after bills and goals

- Tracks subscriptions – no more paying for that gym membership you forgot about

Tactical Play – Use PocketGuard’s “Lower Your Bills” feature yearly. It’s like getting a raise without the awkward talk with the chief.

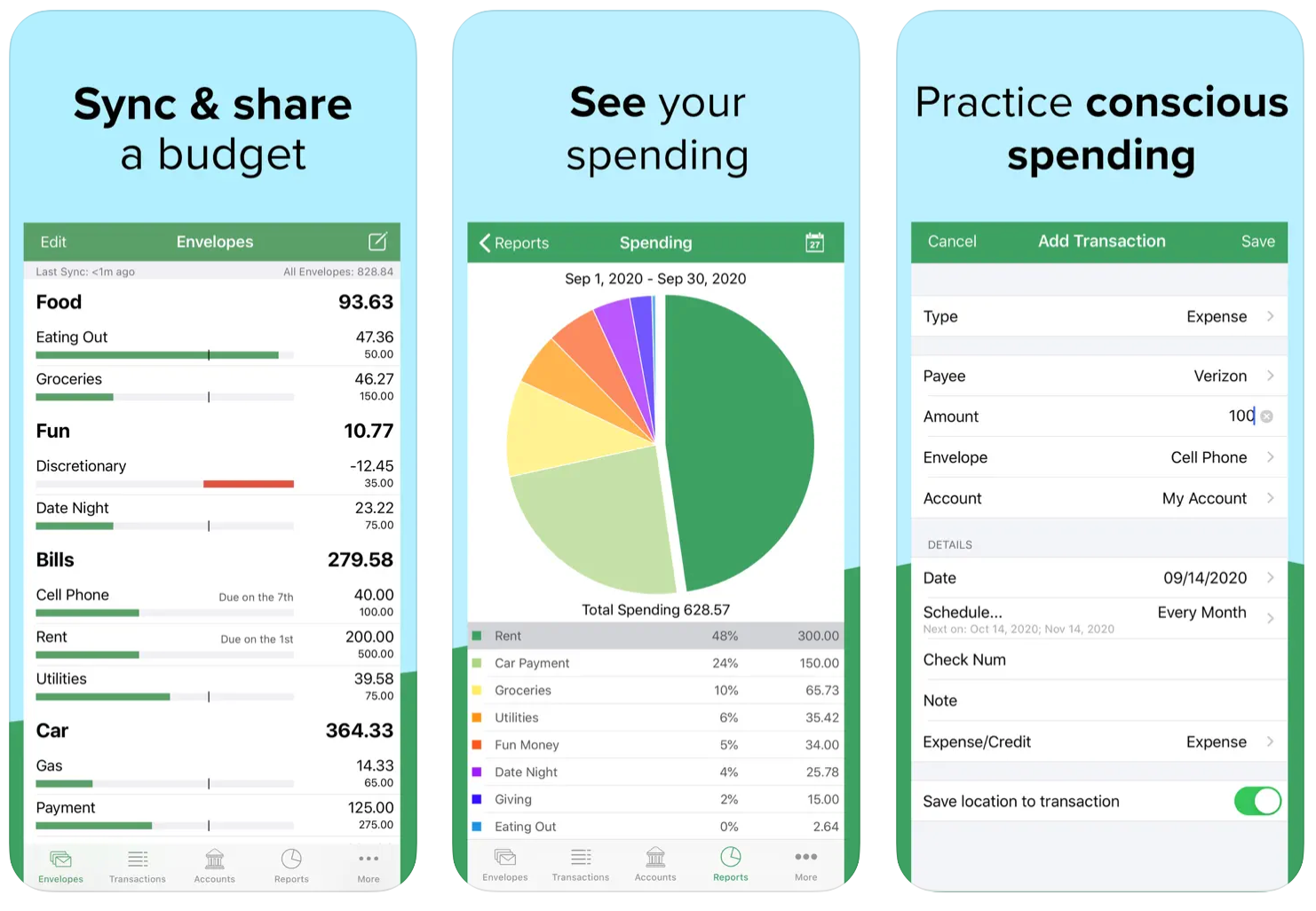

6. Goodbudget – For the Envelope System Lovers

GoodBudget – Old school meets new tech. It’s like organizing your money in envelopes, but without the paper cuts.

- Syncs across devices – perfect for couples

- Uses the tried-and-true envelope budgeting system

- Helps you save for big goals – that new tactical gear won’t buy itself

Pro Strategy – Use the reports feature to spot spending trends. Knowledge is power, and power is money.

7. Prism – The Bill-Paying Ninja

Never miss a bill again. Prism is like having a personal assistant for your finances.

- Consolidates all your bills in one place

- Sends reminders so you’re never late

- Pays bills directly from the app – set it and forget it

Life-Saving Tip – Set up auto-pay for everything. It’s one less thing to worry about when you’re pulling a double shift.

8. Stash – The Micro-Investing Mastermind

Stash – Start investing with as little as $5. It’s like building your financial future one brick at a time.

- Offers themed investment portfolios – align your money with your values

- Provides a stock-back debit card – earn pieces of stock as you spend

- Includes educational content – because knowledge is the best investment

Tactical Edge – Use Stash’s round-up feature. It’s like Acorns, but with more control over where your spare change goes.

9. Credit Karma – Your Credit Score Bodyguard

Credit Karma – Keep an eye on your credit like you keep an eye on a suspect – constant vigilance.

- Free credit scores and reports

- Monitors for identity theft – catches the bad guys before they can do damage

- Recommends credit cards and loans based on your profile

Power Play – Check your credit score monthly. A good score can save you thousands on your next car or home loan.

10. Zeta – The Couples’ Financial Peacekeeper

Listen up, lovebirds in uniform! Zeta is like couples therapy for your bank accounts.

- Merges finances without the marriage certificate – perfect for modern couples

- Tracks individual and shared expenses – no more “who paid for what” arguments

- Sets common goals – because teamwork makes the dream work, on and off duty

Power Couple Move – Use Zeta’s “Money Date” feature. Schedule monthly financial check-ins. It’s like preventive maintenance for your relationship and your wallet.

11. Honeydue – The Relationship Money Mediator

Honeydue is the referee in your financial relationship game. It’s gonna keep you and your partner from going toe-to-toe over money.

- Syncs accounts for both partners – total transparency, no surprises

- Allows you to react to transactions – give a thumbs up or start a chat

- Splits bills easily – no more “I thought you were paying that” drama

Relationship Rescue Tip – Use the chat feature to discuss expenses in real-time. It’s like having a body cam for your spending habits.

Now, Let’s Get to Your Mission Brief

Your mission, if you choose to accept it (and you better, rookie):

- Download at least FOUR of these apps this week. Yeah, I upped the ante. Deal with it.

- Set up your accounts and link your finances. It’ll take 90 minutes, max. That’s less time than you spend polishing your boots.

- Commit to checking them weekly. Make it part of your Sunday routine, like meal prep for the week ahead.

- If you’re coupled up, pick either Zeta or Honeydue and get your partner on board. Financial teamwork is as crucial as having a good partner on patrol.

Remember, in the world of finance, offense wins the game. These apps? They’re your offensive line, your SWAT team, your secret weapon against financial chaos.

Don’t wait for a four-alarm financial fire to start planning. Take action now. Your future self – the one sipping margaritas on a beach instead of working overtime at 65 – will thank you for being a financial badass.

Now go out there and start building wealth like your retirement depends on it. Because guess what, hero? It does.